The Delachaux Group

contemplates a listing in Paris

The Delachaux family would remain the majority shareholder in the long term

Paris, 17 April 2018 – The Delachaux Group, a global player in mission-critical engineered solutions in technology-intensive strategic markets, announced today that it expects to list on Euronext Paris by the end of 2018 in order to accelerate the Company’s growth and development. Following the transaction, the Delachaux family would remain the majority shareholder in the long term.

Founded in 1902, the Delachaux Group designs and manufactures high value-added products, systems and services critical to the safety, reliability and efficiency of its customers’ equipment and infrastructure. The Delachaux Group mainly serves the rail infrastructure, port, aeronautics, logistics and mining sectors. It has developed an undisputed know-how and renowned innovation capabilities. The Delachaux Group is the world leader in its markets through leading brands, such as Pandrol, Conductix Wampfler and DCX Chrome.

The Delachaux Group’s global and local operating model provides strong support to its clients. Operating in more than 35 countries, the Delachaux Group’s 3000 employees are able to be very responsive at a local level. Its Research and Development centres and market experts offer their clients a global vision and an expertise grounded in the sharing of best practices. This decentralized and collaborative management approach allows the Delachaux Group to have an in-depth knowledge of the value chain, as well as of the commercial, technological and regulatory environment in which the Group operates.

Since 2011, when funds advised by CVC Capital Partners invested in the Company, the Delachaux Group has strengthened its positioning by optimizing its portfolio of brands and activities, stabilising the operational profile of its activities and making its business model even more flexible.

The Delachaux Group’s development is driven by its exposure to end markets which benefit from structural growth trends such as investments in infrastructure, green mobility, energy efficiency and industry 4.0.

The Delachaux Group's growth strategy relies notably on consolidating its position in its key markets, maintaining its investments in innovation and conducting a targeted M&A strategy to strengthen its technological and geographical leadership.

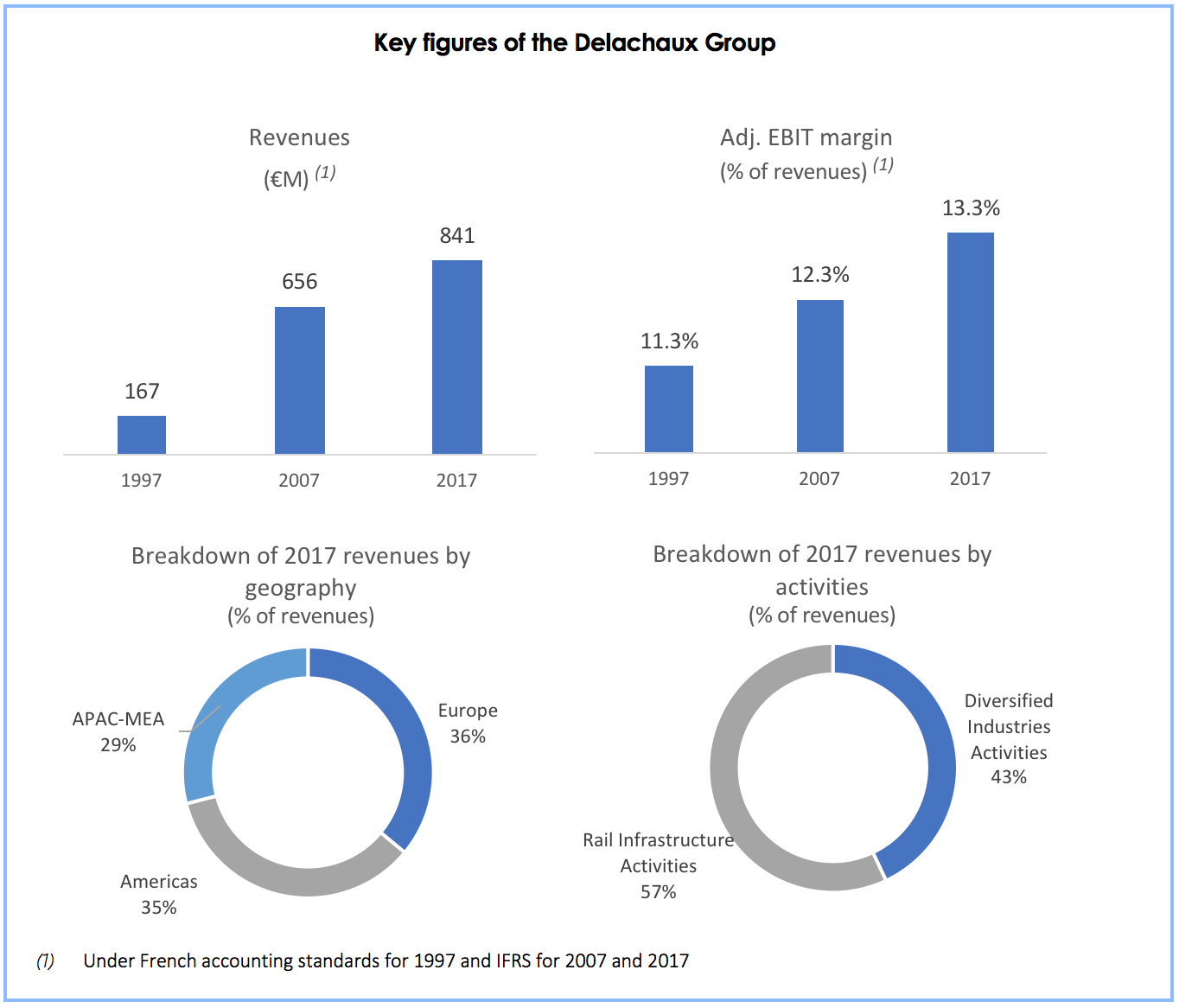

Since 1997, the Delachaux Group has recorded a strong performance and its revenues have multiplied by five reaching €841 million in 2017, with a large recurring share coming from maintenance activities. Adjusted EBIT (current operating income) and adjusted EBIT margin of the Delachaux Group reached €112 million and 13.3% respectively in 2017.

Thanks to this performance and its consolidated position, the Delachaux Group is now contemplating a listing on Euronext Paris. This transaction, which remains subject to market conditions, would enable the Delachaux Group to accelerate its development, strengthen its financial structure and pursue its profitable growth trajectory.

About the Delachaux Group

The Delachaux Group is a global player in mission-critical engineered solutions. The Delachaux teams’ commitment and know-how reflect their passion for their customers’ businesses. The Delachaux Group provides solutions to half of the world’s railways, two thirds of the world’s seaports and half of the planes flying. Family-owned company created in 1902, the Delachaux Group generated revenues of €841 million in 2017. It employs now more than 3000 people in more than 35 countries with the aim to “give the best of Delachaux everywhere”. Present in strategic markets, the Group’s brands Pandrol (Rail Infrastructure), Conductix-Wampfler (Energy & Data Management Systems) and DCX Chrome (Chromium Metal) are recognized global leaders for their reliability, expertise and innovation capabilities.

Press contact

Brunswick – Benoit Grange / Julien Trosdorf

+33 (0)1 53 96 83 83

delachaux@brunswickgroup.com

Financial information for the year ended December 31, 2017

The financial information for the year ended December 31, 2017 included in this press release has been subject to a decision by the company's Board of Directors but is still currently being audited; items could be identified during the course of the audit that would require the Group to make adjustments to the figures presented herein. The results presented in the Group's audited financial statements for the year ended December 31, 2017 may differ from the information presented in this press release.

Forward-looking statements

Certain information included in this press release are not historical facts but are forward-looking statements. These forward-looking statements are based on current beliefs, expectations and assumptions, including, without limitation, assumptions regarding present and future business strategies and the environment in which the Group operates, and involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements, or industry results or other events, to be materially different from those expressed or implied by these forward-looking statements.

Forward-looking statements speak only as of the date of this press release and the Delachaux Group expressly disclaims any obligation or undertaking to release any update or revisions to any forward-looking statements included in this press release to reflect any change in expectations or any change in events, conditions or circumstances on which these forward-looking statements are based. Such forward-looking statements are for illustrative purposes only. Forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Group. Actual results could differ materially from those expressed in, or implied or projected by, forward-looking information and statements.

Disclaimer

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in France, the United Kingdom, the United States of America, Canada, Australia, Japan or any other jurisdiction. No communication and no information in respect of this press release or of the Group may be distributed to the public in any jurisdiction where a registration or approval is required. No steps have been or will be taken in any jurisdiction (other than France) where such steps would be required. An offer of securities in France would only be made after the delivery by the Autorité des Marchés Financiers of a visa on the corresponding prospectus.

This announcement is not a prospectus within the meaning of Directive 2003/71/EC of the European Parliament at the Council of November 4th, 2003.

The distribution of this press release is not made, and has not been approved, by an “authorized person” within the meaning of Article 21(1) of the Financial Services and Markets Act 2000. As a consequence, this press release is directed only at persons who (i) are located outside the United Kingdom, (ii) have professional experience in matters relating to investments and fall within Article 19(5) (“investment professionals”) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (as amended), (iii) are persons falling within Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) or (iv) are persons to whom this press release may otherwise lawfully be communicated (all such persons together being referred to as “Relevant Persons”). This press release is not a prospectus which has been approved by the Financial Conduct Authority or any other United Kingdom regulatory authority for the purposes of Section 85 of the Financial Services and Markets Act 2000.

Securities may not be offered or sold in the United States of America unless they are registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or exempt from registration. This press release may not be published, forwarded or distributed, directly or indirectly, in the United States of America.

The distribution of this document in certain countries may constitute a breach of applicable law. The information contained in this document does not constitute an offer of securities for sale in Canada, Australia or Japan. This press release may not be published, forwarded or distributed, directly or indirectly, in Canada, Australia or Japan.